Q3 2025 Credit Card Charge-Offs Show Signs of Stabilization at an Historically High Level

FOR IMMEDIATE RELEASE

ProVest (561) 312-7602| joel.rosenthal@provest.us

Credit card charge-offs increased only marginally this quarter, while delinquency rates—an early indicator of

future charge-offs—declined slightly but with both remaining elevated.

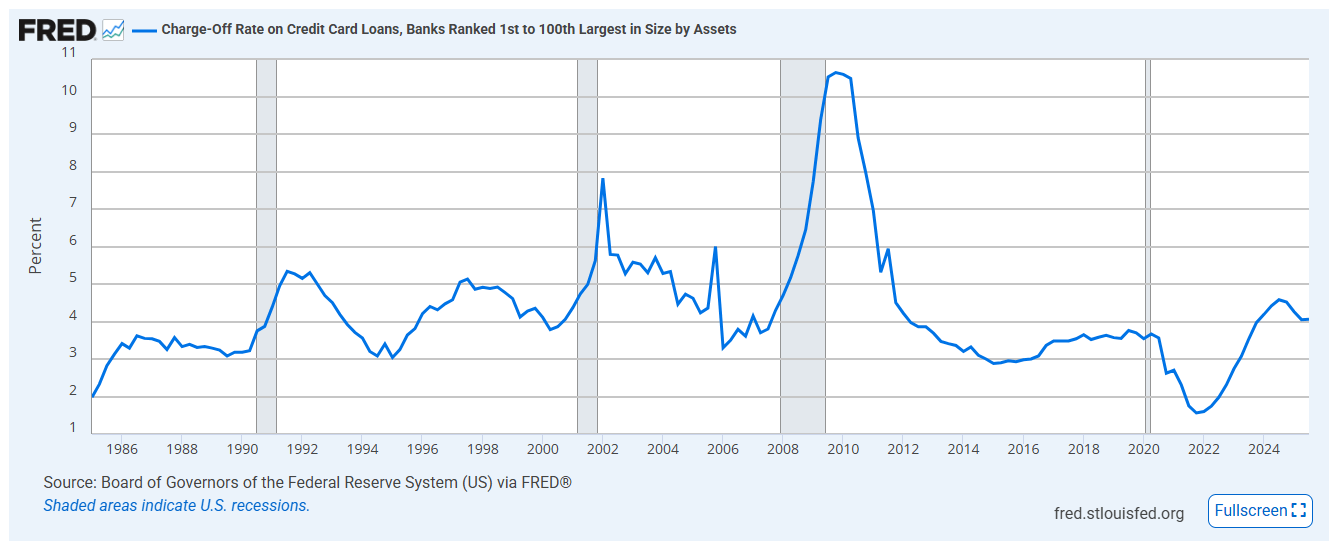

According to newly released Federal Reserve data, credit card charge-offs rose from 4.05% to 4.06%, a very

small increase that suggests the possibility of stabilization following several quarters of fluctuation. Even with

this modest movement, today’s charge-off levels remain historically high compared with the past decade.

Charge-Off Rate on Credit Card Loans

Because legal placements typically trail charge-off behavior by 9–12 months, elevated volumes are expected to remain at the current high level well into 2026.

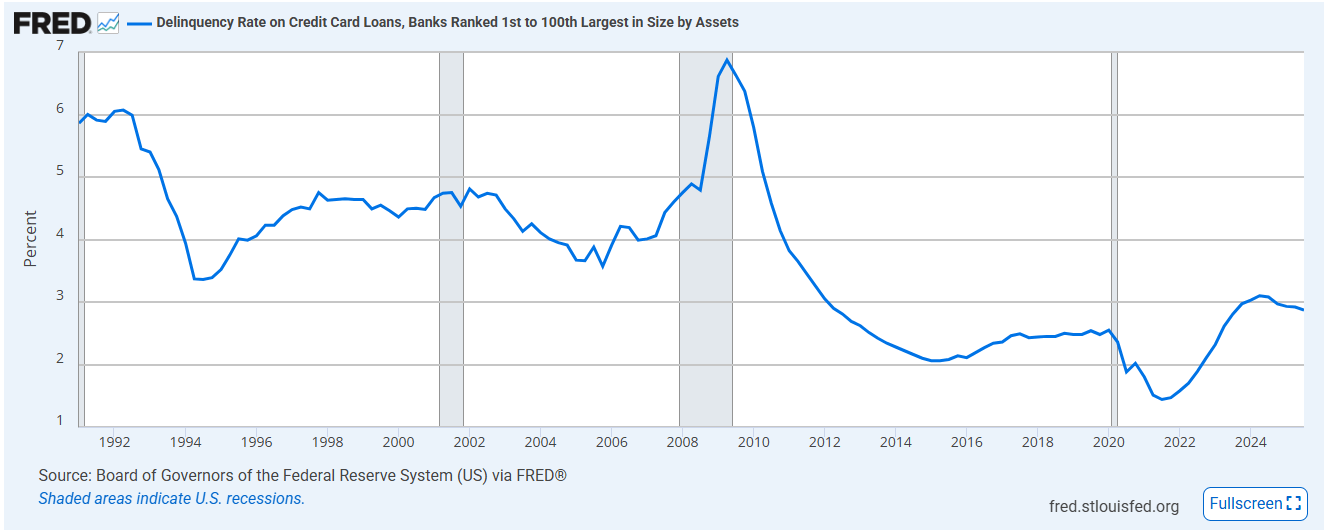

Delinquency Data — The Early Indicator (6–9 Month Lead Time)

Credit card delinquencies—often the earliest signal of future charge-off trends—edged down slightly from

2.92% to 2.87%.

Importantly, the last four quarters have all remained within a narrow band, showing a subtle downward

trend but overall forming what appears to be a high-level stabilization.

Although still not definitive, the past year of data suggests account volume may be settling into a new, elevated plateau compared with the prior 10-year historical averages.

Interpreting the Convergence: Stabilization at High Levels

With both delinquencies and charge-offs showing tighter, flatter patterns, the data increasingly points to a period of stabilization—but at a significantly higher base level of account volume than the post-2014/pre-COVID era.

Despite the potential stabilization in account volume, the average credit card balance in dollars continues to increase. This has increased nearly 6% year over year and 2% since the last quarter.

By: Joel Rosenthal | ProVest

VP Credit Collections Business Development & Client Relations

Joel.Rosenthal@provest.us | (561) 312-7602

![]()

About ProVest

ProVest plays a critical role in the legal process by ensuring that defendants in a legal action have been properly served process. The Company specializes in managing the service of process related to creditors’ rights and mortgage defaults. Today, ProVest annually serves millions of documents for the country’s most notable law firms, financial institutions and insurance companies. Learn more at www.provest.com.